How to keep shipping to USA

**I’m not an expert, this is all based on my ADHD driven research. I advise you to do your own research and consult with experts when needed.

It turns out most packages sent from makers in Canada to customers in the United States would qualify for CUSMA but since the $800 de minimis existed there wasn't a huge need to spend the time worrying about that. Canada-United States- Mexico Agreement gives tariff free entry if the product meets the originating requirement.

TIP: Your pottery likely already qualifies for CUSMA you just need to do the right paperwork

August 29 Update

Canada Post must continue to charge 35% IEEPA Tariff even for CUSMA goods.

This took me by surprise when Canada Post finally made some updates online and got set up with Zonos Prepay. I like many others figured that the new software that can assign 10 digit HS codes (not very accurately from playing around with it) would have a feature to allow upload of Certificate of Origin or something that would avoid duties on CUSMA goods. There was no way of uploading documents or even correcting HS codes. It turns out this is the case because postal shipments are STILL SUBJECT TO 35% TARIFF and Canada Post isn't just being lazy. I was ready to write a frustrated email to Canada Post but decided I should do some more research first. It turns out that the Executive Order ending the de minimis that introduced their duties on postal goods by either a valorem or flat rate fee includes all parcels including those in CUSMA.

Executive Order “Suspending Duty-Free De Minimis Treatment for All Countries” (EO 14324), signed July 30, 2025, effective August 29, 2025

Section 2(a):

“The duty-free de minimis exemption… shall no longer apply to any shipment… regardless of value, country of origin, mode of transportation, or method of entry.”

Unfortunately this encompasses CUSMA-originating goods - even if previously exempt via trade agreements.

What This Means for CUSMA Goods and Canada Post

Even if your goods qualify under CUSMA and have proper documentation, postal shipments are still required to pay IEEPA tariffs - either based on value or via flat fees.

CUSMA preferential treatment does not override this posting-specific rule.

The Good News:

We are not completely screwed - Commercial/courier shipments, however, still follow standard CBP trade-entry procedures. meaning CUSMA-origin goods can be duty-free, provided they go through appropriate filing in the Commercial Automated Entry system (ACE).

This means we need to use a company like Chit Chats or Stallion Express. Many folks have been using these for cheaper shipping already, I personally had stuck it out with Canada Post for my US shipments but I know many that really like these alternatives and have same some money with them.

These companies are all scrambling to address CUSMA products, it seems like you will need to set up each product you intend to ship as an item in their system with a sku. You will then submit all of the information we have been working on figuring out for our products for the certificate of origin, they will review and hopefully approve it so when you ship items of that sku you do not get charged a duty. I think each of them will probably have a small fee associated with them doing this, it will be much cheaper then the duties you would be paying at Canada Post.

I have reactivated my ChitChats account and will share what the steps are through it to get CUSMA items approved once it goes live on their website.

If you are having any success with a company besides ChitChats or Stallion Express please let me know so we can spread the word.

Non Canada Post Shipping Options

There are a bunch of different companies you can use to ship CUSMA items to the states that are not Canada Post. And with the strike on this options will help you ship domestically and to other countries beyond the USA. You can go directly to courier like UPS, Fedex, Purolator etc but sometimes those prices are higher and then you are stuck with just looking at that one company or needing to navigate between courier websites.

The popular solution is a ... 3rd party shipper, I think that's what they're called. A company that is set up to prioritize your needs and has many shipping options available to you. You can compare companies, speeds of shipping within each company etc. Some of these companies are Click Ship, Freightcom, ChitChats, Stallion Express, and NetParcel. These companies came up in my research as similar to the previous but I have not tried them or researched further - Easyship, Sendle, Ship Station, and Shippy Pro.

I tried out a bunch of the shipping options and for me Click Ship is easily the winner.

Click Ship www.clickship.com

Click Ship is a sister company to Freightcom. I had to google it because I didn't know what made the 2 different. I turns out that ClickShip is more focused on e-commerce which is actually perfect for most of us. I have been using freightcom for my domestic shipping for a while, it was easy to use and cheaper than Canada Post, I really wanted to support Canada Post but I got frustrated that I could send the exact same package to the states for less than within Canada, how does it cost less to send to Hawaii or Alaska for less than it cost me to send it to Vancouver or Edmonton.

I switched over to ClickShip on recommendation of Aaron Raymond and connected with the account manager they were working with Shawn and they've been super helpful. I recommend you also reach out to Shawn at Click Ship shawn@clickship.com . If you want to set up an account right away and get Shawn's help use his code when registering: Savewithshawn.

Why I like Click Ship the most of all options I've tried

No Issues - They really know what they're doing, I've had zero issues and everything has made it through the border quickly unlike with ChitChats - I had shipment caught up with them for ages. and if I had any issues I could contact Shawn for help.

Affordable and all in one pricing - Prices including brokerage fees are comparable to what Canada Post cost me with my small business account at savings level 4. And as a bonus shipments are usually faster than Canada post was.

Ships everywhere - This is especially important with Canada Post striking , you can ship internationally or domestically. I sent packages this week to USA, Australia, UK and within Canada.

Connects to my website - The focus of Clickship is ecommerce, it integrates with a ton of different sales platforms. It is so handy to have all of you orders show up right on click ship, click "ship it" and start setting up your shipping label.

CUSMA - They know how to handle CUSMA shipments well. You still need to gather all of your CUSMA information but you don't submit skus ahead of time for pre-approval on ChitChats or StallionExpress. You fill out all of your information digitally, upload a copy of your CUSMA certificate or origin when you're setting up shipping labels, skipping the need to attach to the outside of the box. I still attach them to the outside because I like to over do everything. I use the CUSMA certificate or origin/commercial invoice template I made up and have available on this page. If you like your shop to ClickShip it will generate a commercial invoice, again I still attach mine.

Don't forget that you need to label product made in Canada - stickers will work.

Notes:

Read the specifics on each shipping rate - not all include brokerage fees, I wanted to stick with ones that will have no surprises later on. For the USA I go with Fedex International Connect. Price is comparable to what I paid through Canada Post and is faster.

If the prices that show up for you seem unnaturally hight click on the price and see what the breakdown is. I happen to live in a small town and it's outside the typical fedex pickup area so there was an extra $25 charge added on. I set up my work address in Ottawa as a shipping location and rechecked using that location and prices were way better. Since I'm not in Ottawa frequently I use the Ottawa address but drop off at a fedex drop off location much closer to where I live like the staples in the nearby town.

This one has been around for a while and while many people swear by it but I have heard some folks over they years not love it. A downside is there are not drop off centers easily accessible across all of Canada - you can pack up a bunch of orders in one big box and ship to them if that is the case. You would need to look into the fesability of that but based on a 35% tariff plus tons of fees it might still be cheaper with Chit Chats

On August 29th they launched their system to allow users to get their CUSMA products pre approved by their broker so they correct access if duties are needed when you go to ship packages to the united states. When this feature launched I submited a number of items and it may take a few days to find out if everything is approved or not. I will update as soon as I do.

I recorded my screen while I was setting up my products and submitting them for approval. I don't know if its needed because ChitChats made a video of how the process works.

Click here for a link to Chit Chats information page about all this and below i included the video they made.

Fees for Chit Chats on top of postage This is the link to where this information came from as of August 30th https://support.chitchats.com/en/support/solutions/articles/47001205608-what-are-ddu-and-ddp-postage-types-

Prepaid Fees with DDP

When purchasing DDP postage, the following fees are included upfront:

-

Duties & Tariffs – calculated based on the HTS code and Country of Origin.

-

Merchandise Processing Fee (MPF) – flat fee per shipment set by U.S. Customs and Border Protection (currently $1.35 USD; subject to change).

-

Shipment Items Fee – $0.15 USD per line item (e.g., 1 t-shirt, 2 mugs, and 3 pins = 3 shipment items).

Note: These fees are subject to change. We’ve worked to keep them as low as possible to help offset the added cost of paying duties upfront.

If this is the case it would only cost $1.50 USD on top of shipping cost with Chit Chats. Canada Post's Zonos app had my fee at over $60 before shipping.

Click here to go to the IG reel I made showing you how to set up a shipment on ChitChats

If you watch the video you will see that besides postage and optiona insurance the only extra fees to ship CUSMA goods are $2.07

Other shipping options

I am still working on testing out Stallion Express and Net Parcel. Is there any other people are interested in? let me know and I will see how they work and report back.

Stallion Express - If you click this referral link you should earn $25 credit right away. Or you can use the referral code td1rd3 . Stallion Express is a bit different that you need to pay for the initial CUSMA submission to have your product approved before shipping duty free. This credit can be used for that.

So far with Stallion Express I tried setting up my earthenware mugs and the HS Code brings up an FDA Flag FD2. There is not a way to resolve it that I have seen. I was able to set up pottery clamps but they had me use a different HS code than I typically do. I have not been able to test it any further yet.

So What Qualifies for CUSMA?

To qualify for CUSMA, goods must generally meet one of the following criteria:

Wholly Obtained: If a product is entirely grown, extracted, or harvested in one of the CUSMA countries, it is considered originating.

Produced in CUSMA Countries: If a product is made in one or more CUSMA countries using materials from those countries, it can also qualify if it meets specific product-specific rules of origin (PSROs).

Significant Transformation: If a product is made with some non-originating materials, it can still qualify if the non-originating materials undergo a significant transformation within the CUSMA region, often defined by a change in tariff classification or a value-added requirement.

Handmade Pottery easily qualifies for CUSMA

HS Code and HTSUS Code

Determine what the correct HS code is. This part is really important, I thought I had the right codes figured out but following the HS codes to get confusing, 6 digit codes are used worldwide, Canada uses 8 digit codes and USA uses 10 digit.

HS Codes and especially HTSUS codes are a pain, you really need to be careful to make sure you select the right one. I did have same samples up initially but through researching classification requests made to CBP and more research I believe I have figured out some examples of more accurate codes. These are some HS Codes for Earthenware/Stoneware, I'm continuing to research and will add more options including for porcelain. If you have HTSUS Codes that you use please let me know.

Origin Criterion

Decide whether your pottery is CUSMA Criterion A (if all clay/glazes from North America) or Criterion B (if imported raw materials but fully transformed in Canada). I went with Criterion B as some of my raw ingredients may be from outside North America.

Resource: Canada Tariff Finder

Head to www.TarrifFinder.ca (it just has 2 fs in it, even though you would have assumed 3)

The Canada Tariff Finder is the result of collaboration between BDC, EDC and the Canadian Trade Commissioner Service of Global Affairs Canada.

This is the most straight forward tool I have found to look up HS Codes/HTSUS Codes. This isn't a new tool, it's been around long before this recent tariff issues and it works for looking up information for shipping to more than just the states.

Here is a video of how you can use it, I go through looking up codes for Earthenware/Stoneware mugs and then repeat for porcelain mugs

CUSMA Certificate and Commercial Invoice

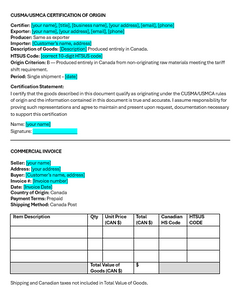

After a bunch of research I made up a CUSMA Certificate template and a Commerical Invoice template that I will use.

Format does not matter as long as it has all the required information: Certifier, Exporter, Producer, Importer, Description of goods, HS code, Origin criterion, Period, Certification statement, Signature

The Origin Certificate on the USA Customs and Border Protection website is there just as a template. When NAFTA was in place that document was required, in CUSMA there is not set document or format.

Country of Origin Label

It is super important that you label your products. The more permanent the better, stamping made in Canada into the bottom of your pots is probably better than applying stickers that could fall off.

If you are doing stickers (as I did because I wasn't in the habbit of putting made in canada on my pots) you want to make sure they are legible and as secure as possible.

Don't write Made in Canada on in marker or use something like masking tape - you want it to be more official looking than that and secure enough that it will still be attached/visible when it makes it to the customer.

ChitChats and other companies are opening packages to confirm it is there because it is required for CUSMA imports into the United States. Before de minimis ended it wasn't really needed because we were not needing to declare if a product was CUSMA or not, but since we want to save our customers paying duties we have to follow all of the rules.

**Again I’m not an expert, this is all based on my ADHD driven research. I advise you to do your own research and consult with experts when needed. I will update this page as I do more research, there is always the possibility I have been super wrong somewhere and will need to make some corrections

Keep in mind that things are constantly changing and you may need to revise your plan for shipping to USA frequently